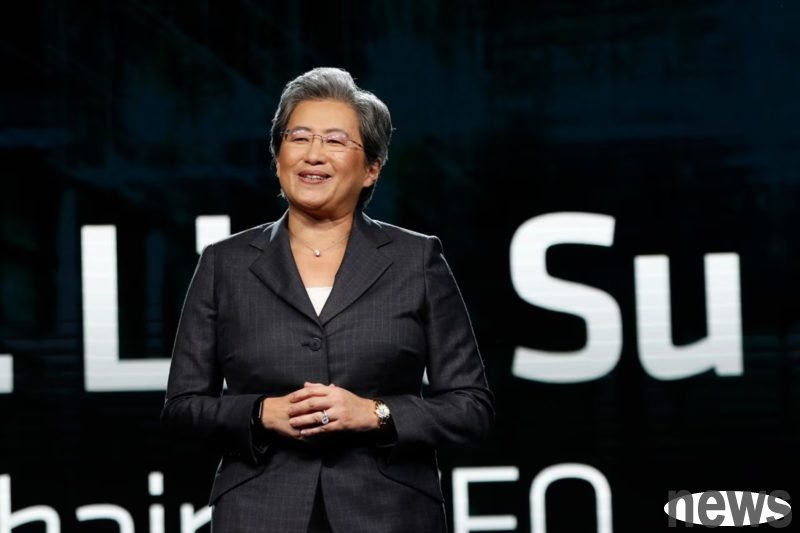

According to foreign media reports, Su Zifeng, executive director of Ultramicro (AMD), said at an artificial intelligence (AI) event held in Washington, USA, that the cost of artificial intelligence (AI) chips purchased from Taiwan's Arizona crystal factory is about 20% higher than in Taiwan. This information highlights the complexity and high price of establishing semiconductor supply chains in the United States. But despite this, for large technology companies such as AMD and NVIDIA (NVIDIA), purchasing chips from NTU US factories seems to be one of the options that are not selected under the current supply chain environment.

According to wccftech's report, there are many reasons for the higher cost of producing chips in the United States, the most noteworthy of which include expensive labor, higher costs of imported equipment and construction facilities, and the current state of immature chip supply chains in the United States. These factors lead to customers such as Ultramicro and NVIDIA, which have to pay 5% to 20%, or higher, to purchase chips in the United States.

The report pointed out that before NTU invested in the U.S. factory, the local chip supply chain in the U.S., especially the production of advanced process stages, was insignificant. Apart from Intel, almost no other chip company in the United States can meet the market's demand for advanced chips. Taiwan Electric's factory in Arizona, especially the sharply accelerated pace of expansion under the Trump administration, began to change this situation. However, what comes with it is high operating costs.

However, despite the high costs, companies are still willing to purchase chips from Taiwan Electric's U.S. factory. The main reason is that Taiwan's production lines are currently fully loaded. Therefore, the high-priced spots offered by the Arizona factory area have become the second choice for large tech companies. Judging from the NTU's business in the United States, this trend is obviously continuing.

reported that AMD is one of Taiwan Electric's major customers in the United States, not only the first companies to place 4-nanometer orders to Arizona factories, but even plans to further expand to 2-nanometer processes, especially its EPYC Venice series data center CPUs. AMD executive director Su Zifeng pointed out that the demand for AI chips will not be relaxed in the foreseeable future, and the number of orders for partners is unprecedented. So, she predicts that the global AI chip market will reach an amazing $500 billion in the next five years. This huge market demand has prompted companies to be willing to ensure their chip supply even when facing higher costs.

In addition, TAI itself is also extremely committed to establishing an independent chip supply chain in the United States to meet Taiwan's production capacity. It plans to produce more than 30% of advanced chips in Arizona. It is worth mentioning that the NTU Plan's factory in Arizona uses unmanned machines for monitoring, indicating that its production operations in the United States will also integrate advanced technology and technology.