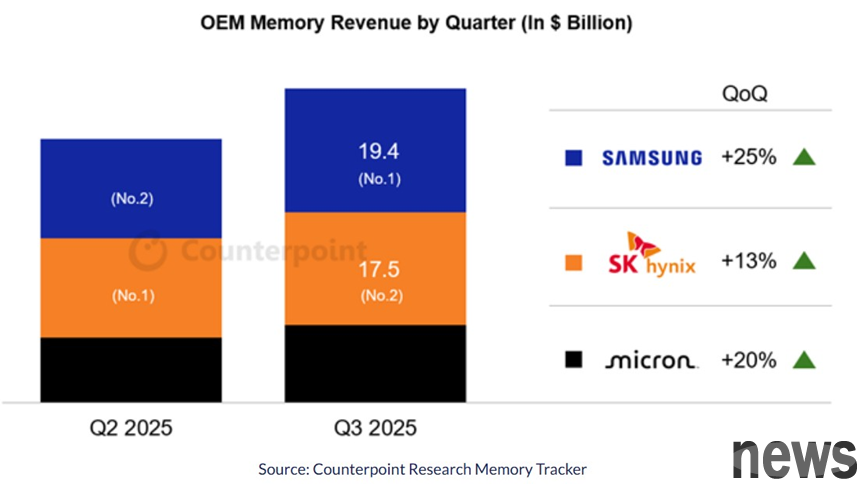

According to the latest memory tracking report from Counterpoint Research, the global memory market will continue to rebound in the third quarter of 2025. Samsung returned to the top spot in the world with memory revenue of US$19.4 billion, while SK Hynix ranked second with US$17.5 billion.

The market growth in the third quarter was mainly driven by the steady recovery in demand for traditional DRAM and NAND. In comparison, the performance of the high-bandwidth memory (HBM) market is still relatively weak this year. However, with the introduction and mass production of HBM3E and HBM4, it is expected to bring significant growth momentum to the market starting from 2026.

Samsung saw a rebound in many business areas in the third quarter of 2025, offsetting a relatively weak performance in the first half of the year. In the memory business, Samsung lost its leading position in the DRAM market in the first quarter and ranked second in the overall memory market in the second quarter, but returned to the top spot in the third quarter.

In the field of smartphones, the launch of the Galaxy Z7 series has boosted the sales share of foldable phones. According to Counterpoint Research Market Pulse data, Samsung's smartphone sales in the first two months of the third quarter increased compared with the same period last year, reflecting a recovery in market demand.

Counterpoint Research senior analyst Jeongku Choi said that Samsung was affected by HBM market performance in the first half of the year, but regained its leading position in the global memory market in the third quarter. This shows its stable performance in product quality and operational efficiency. With the widespread adoption of HBM3E and HBM4, 2026 is expected to be an important growth stage for the memory market.

Further reading: Arm takes a big step into the data center! Rumored to cooperate with OpenAI to develop server CPU New options beyond x86? AMD is rumored to launch Arm architecture APU next year, but shipment list is suspected to be missing